Introducing Open Banking To Canada

Industry: Fundraising & Donations

Project: Mobile App Design

Role: Product Designer

Scope: User Research, UI/UX Design, Branding, Prototyping, Usability Testing

Background

During a trip to London, UK, I encountered a digital bank app that caught my attention as a freelancer who occasionally receives payments from UK clients. This experience made me realize the lack of similar digital banking services in Canada, despite the presence of digital companies. Research revealed that Canada has not fully established its Open Banking API interface standards, which is crucial for advancing its banking services. Open Banking, being a transformative concept, has the potential to revolutionize the financial industry in Canada, making banking more user-centric, transparent, and efficient.

Problem

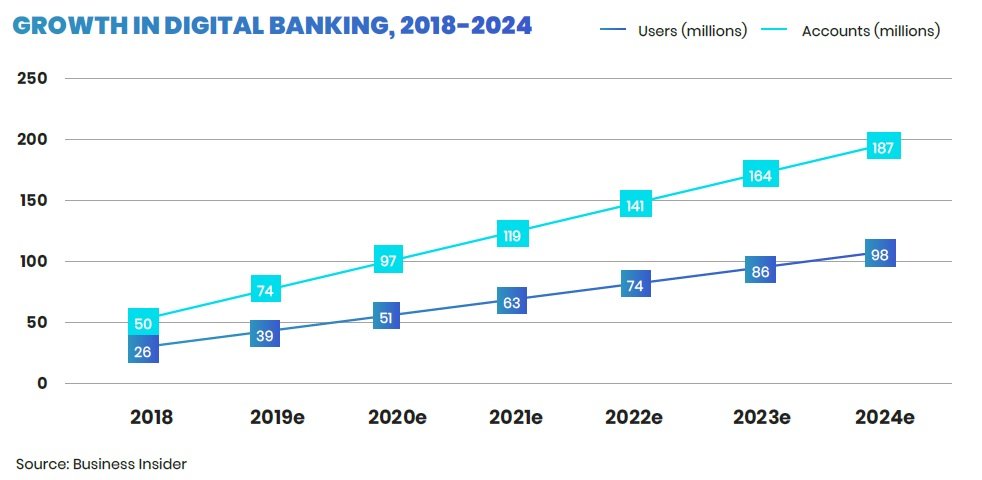

The new digital user, especially millennials, wants transparency, privacy, and control of their data. However, Canadian digital banks currently operate like conventional banks, offering little transparency and user control of transactional data, especially when it comes to dealing with third party data usage. The Big 5, Canada's largest established banks, dominate the market and operate in archaic ways that marginalize the new digital power user. This is where we see a need for modern banking services that can compete with global changes in banking and technology using Fintech.

It is important to address this problem because digital banking has become the norm in many countries, and Canada risks falling behind in terms of innovation and competitiveness. By introducing a modern and user-friendly banking app like Akila Fintech, we can create a more inclusive and accessible financial system that caters to the needs of all users. Moreover, the app can benefit users by providing them with a more convenient and secure way to manage their finances, with features such as easy payment transfers, budget tracking, and digital security measures. By solving the problem of outdated banking services in Canada, Akila Fintech can help usher in a new era of modern and user-centric banking for all Canadians.

The Goal

The goal is for the government to build an API interface standard legislation that every Fintech company must comply with to have easier communication and access to the majority of the financial market. By doing so, we can welcome startups to compete with The Big 5 and innovate accordingly to the consumers' needs with full transparency, control, visibility, and convenience. The millennial user needs must be considered, prioritized, and designed for. In this way, we can empower digital first users and high-growth segments to use modern banking services that are suited for their needs and are on par with global standards.

What is open banking: Is a secure technology (API), that allow the consumer or an SME(small or medium enterprise) to safely share their transaction data with an authorized third party regulated by the FCA or equivalent. It also enables the consumer or SME to instruct that third party to said a payment from their account if they want to. This is a very big change, from a banks perspective this is a very interesting change they have with their consumer.Its not as foreign as it sounds Any consumer that has used Uber, or Amazon Click have already been using a form of open banking, but the difference is with API interface standards for digital banking is much safer, secure, and easier to use. API is simply an enabling technology just like the internet. The internet is not just used for emails or FTP, but businesses use the internet to promote products and service to consumers, and open banking will probably take off a life of its own and be used in a similar way.

How Does it improve managing Money?

Open banking can help you manage your money more effectively by allowing you to view all of your accounts from multiple banks in one app. To do this, you can choose a regulated third-party money manager app that uses open banking practices. After granting secure access to the app, your bank will ask you which data you want to share and for how long. The app can then analyze your spending, providing you with an easy and efficient way to manage your money.

How Does It Work?

Open banking enables you to securely authorize regulated third-party providers to access your bank transaction history and make payments on your behalf. It has transformed the way people bank worldwide, particularly in Europe, by providing customers with greater transparency and control over their finances. With open banking, customers can Move, Manage, and Make more of their money. You have the ability to choose which transaction information to allow access to and can stop access to your data at any time.

Why is open banking important?

Open banking is important because it gives you the right to access and control your financial data, which was previously restricted by major banks. Startups and SMEs are already offering better money management services, and traditional corporate banks are playing catch-up. However, big banks face challenges in adapting to changing trends, which can take up to two years to implement. In contrast, new SMEs can implement changes quickly, usually within three weeks due to their small size. Open banking promotes innovation and entry to financial services.

The Foundation of Developing a Modern-Day Digital Banking App

In order to develop a successful digital banking app that caters to the needs of modern-day users, extensive research and analysis were conducted to gain insights into user behavior, market trends, and technological advancements.

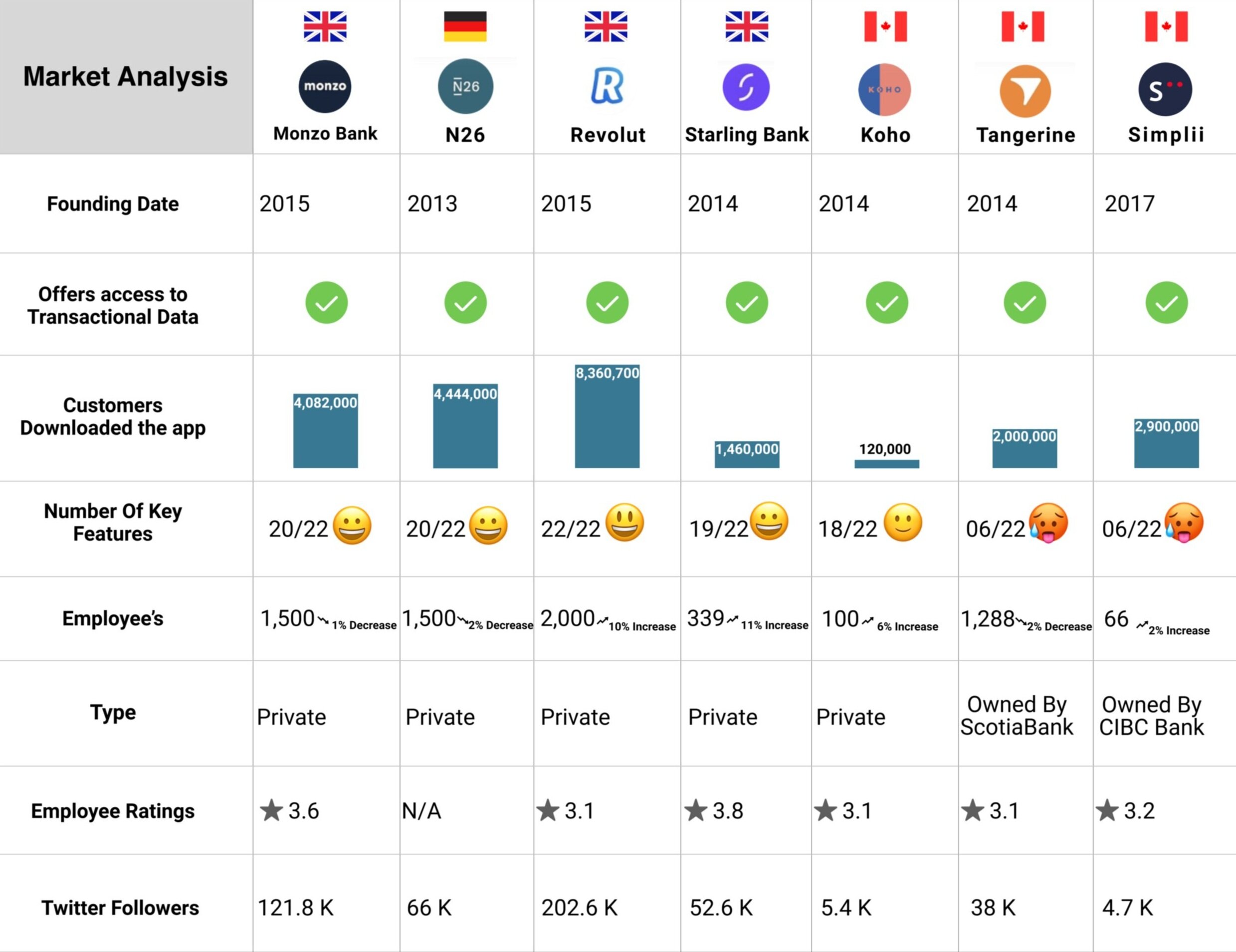

Firstly, a market analysis was conducted to understand the current state of the Canadian banking industry and identify gaps and opportunities for innovation. The analysis included a review of the Big 5 banks' services, as well as other digital banking apps available in the Canadian market. This analysis revealed that the current banking system in Canada is outdated and lacks innovation, with limited digital features and high fees. This presents a significant opportunity for a modern and user-friendly digital banking app like Akila Fintech.

user research was conducted to understand the needs, pain points, and expectations of modern-day users in the Canadian banking market. The research included surveys, focus groups, and interviews with users of various age groups and backgrounds. The findings revealed that modern-day users, particularly millennials, value transparency, control, and convenience in their banking experience. They also expect a high level of digital security and privacy, as well as easy-to-use and intuitive features.

In addition to market and user research, technological research was conducted to identify the latest advancements and trends in digital banking technology. This included an analysis of Open Banking APIs, which enable third-party apps to access a user's banking information with their consent. This technology provides a significant opportunity for Akila Fintech to provide innovative features and services that cater to users' specific needs and preferences.

Founded in the same year as its main competitor Revolut, this bank paved the way for customers mobile first approach for digital banking, using Analytics & insights and than actioning the findings for the user with their feedback. Even though they are 2nd in the UK market, they have a higher customer satisfaction.

One of the first digital banks to be introduced in Europe, and has the second highest amount of users just after its direct competitor is Revolut. Based out of germany they mainly focused on improving banking for the locals tired of conventional banking, by simplifying it for them, and giving them control of their finances

This bank is no doubt the biggest digital bank in Europe with the highest amount of users and are expanding to many countries rapidly, and offer investment and cryptocurrency features.

Though Starling was founded a year before Monzo, there growth was not as good as there competitors, mainly because of funding, however they are still the 3rd top digital bank in the UK recently reaching just over a million users.

This bank has so much potential in the Canadian digital banking industry, but due to Canada’s prolonged adaptation of the open banking system they aren’t as big as the European digital banks, however they are definitely Canada’s first truly transparent Digital Bank.

This bank is a subsidiary of CIBC Bank in Canada, and operate more like the traditional banks. They are still very behind with features that most digital banks are offering to their users.

This bank is a subsidiary of ScotiaBank in Canada, and operate more like the traditional banks.

They are still very behind with features that most digital banks are offering to their users.

To be a competitive digital bank, it's essential to have certain key features; otherwise, you'll be no different from a traditional bank. The banking industry is evolving with new and exciting features that are specifically designed & tailored to meet the end-users needs.

This side-by-side comparison of 22 features illustrates what digital banking and fin-tech companies offer today. Consumers want simplified and easily manageable financial services. However, digital banks are still operating like traditional banks and are not adapting to the needs of digital users. Instead, they continue to cater to in-person users.

They offer 20/22 features I’ve listed which are critical features for fin-tech companies.

They offer 20/22 of the features listed and is still very good and can easily compete with other fintech companies.

They offer 22/22 of the key features listed in the analysis, and is in more locations around the world.

They offer 19/22 of the key features listed. Starling Bank is one of the top digital banks established in UK.

They offer 20/22 features I’ve listed which are critical features for fin-tech companies.

They offer 06/22 of the key features listed. Subsidiary of CIBC. Digital bank but operates like a traditional bank.

They offer 06/22 of the key features listed. Subsidiary of Scotia Bank. Digital bank but operates like a traditional bank.

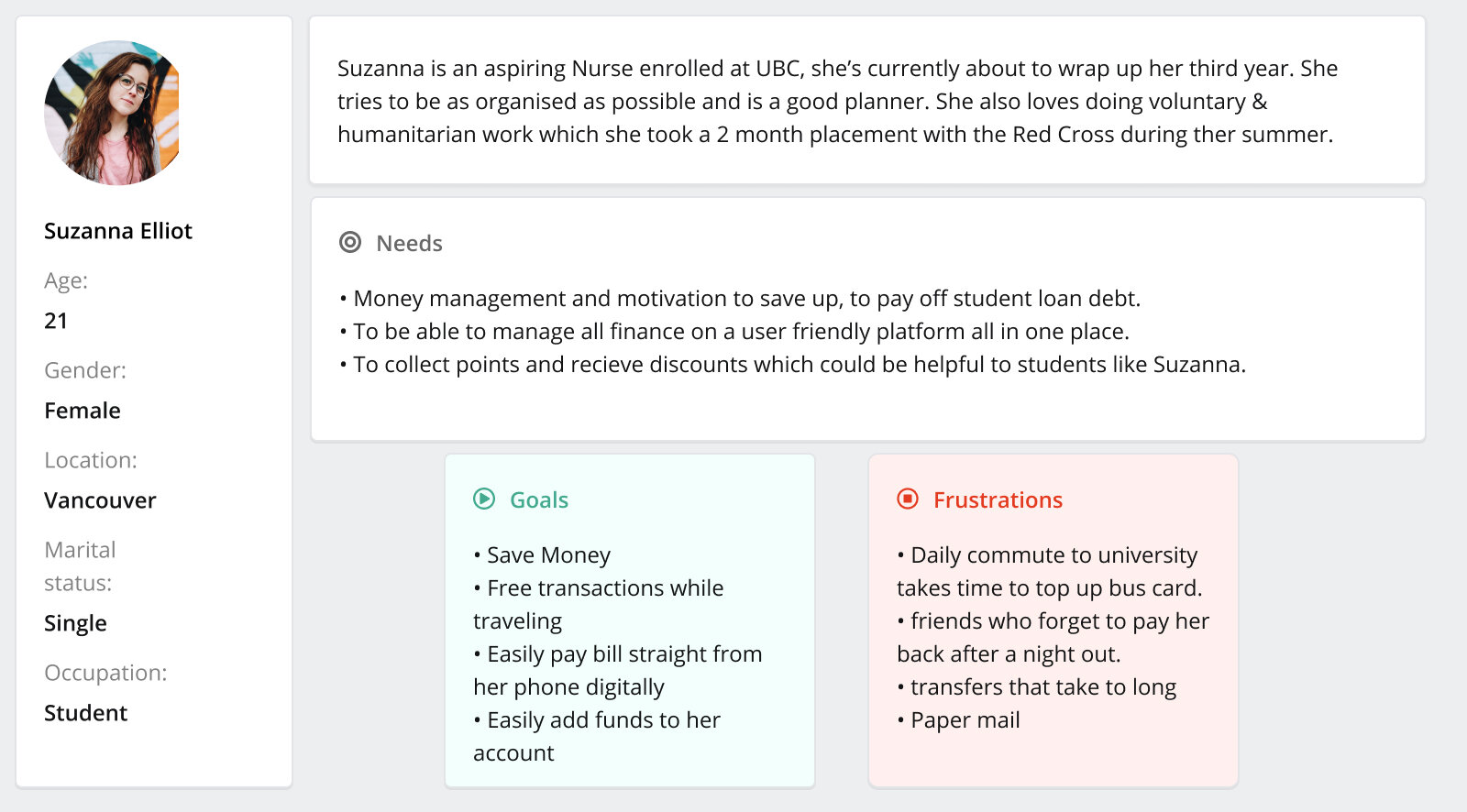

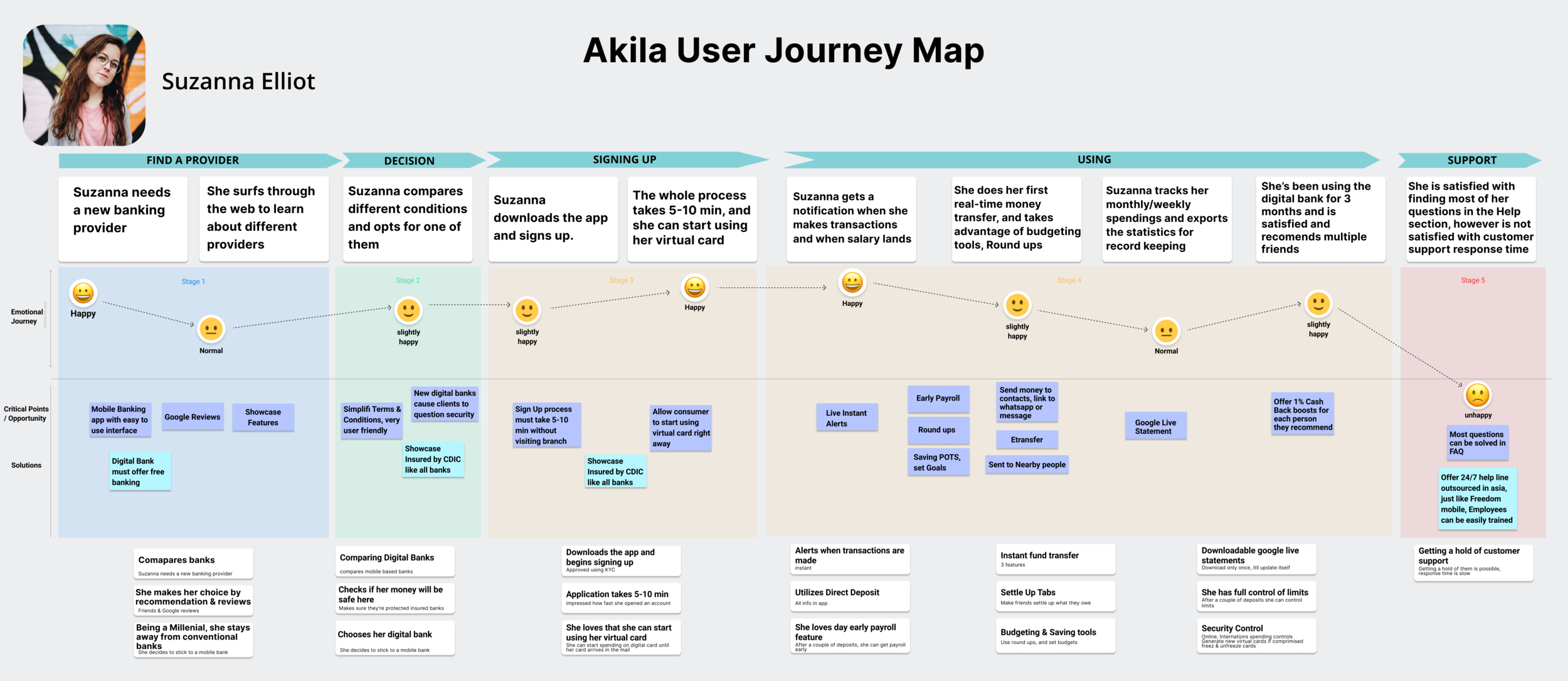

Before starting any design efforts, it's crucial to validate solutions through user research. By conducting multiple interviews, identifying pain points, and gaining insights, I was able to discover patterns and aggregate my findings into a persona. I focused on a persona that represented the highest revenue value and had a significant year-over-year user growth for this vertical - the millennial.

PSD2 (From the EU)Payment Services Directive is a set of laws and legislations set by the european parliament. The directive was approved on October 8th 2015, and passed by the European union on november 16 2015. Its a continuation of the original payment services directive PSD1 which was introduced in 2007. PSD2 aims to secure e-payments & expand the financial services ecosystem.

PSD2 opens the value chain for new entrants, various roles in the value chains can be for instance

ASPSP ( Like Amazon )

Account servicing Payment Service Provider

- Consumers bank, current issuer

PISP (Like a bank)Payment Initiation service provider

- initiates the payment process, seller or PSP

AISPAccount information Service Provider

- Consolidates customers data, “cross-bank

Overall PSP (Payment services providers) as listed above, must follow certain requirements. Such as strong customer authentication, or electronic remote payments. At least two out of these factors are required for the strong customer authentication.

KYC is a regulatory requirement, which the banks and financial institutes need to fulfill by identifying they’re customers. KYC verification helps online businesses in verifying they’re customers, preventing online fraud & financial crimes, and complying with KYC and AML regulations.

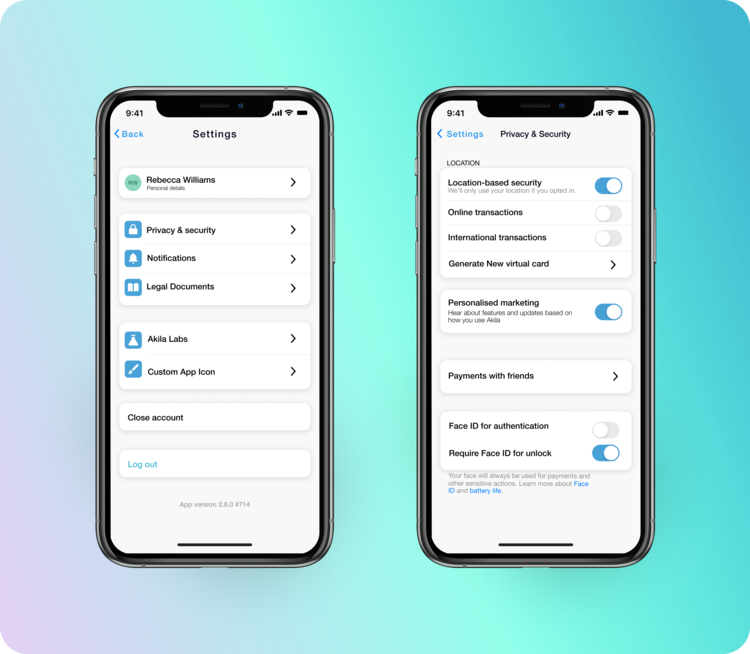

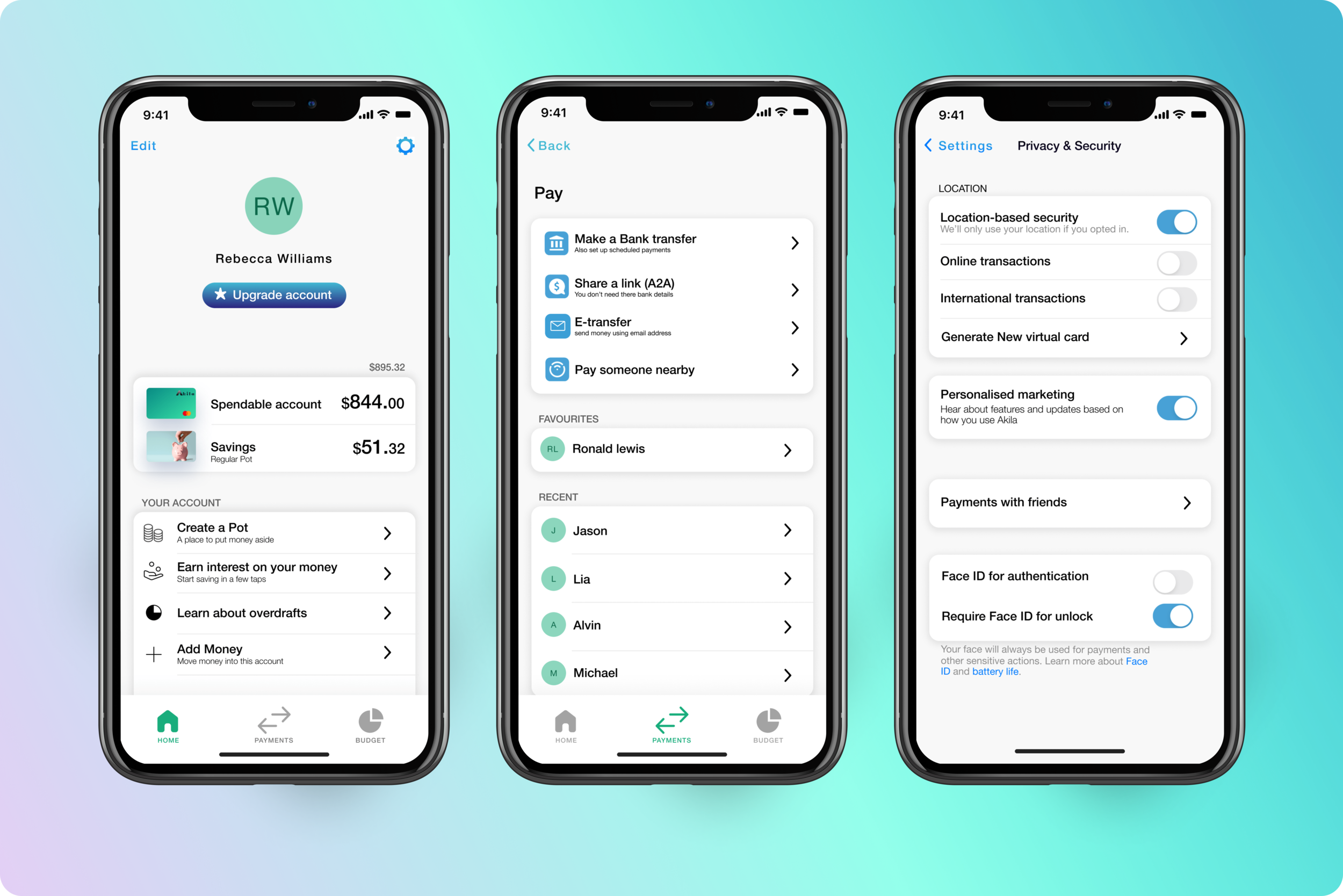

Location-Based Security: By using your phone's tracking device, this feature ensures that any purchase made from a location other than your phone's location will be denied.

Control over Online Transactions: It's better to keep this feature switched off when you're not shopping online. Remember to switch it on when you do make online purchases. Also, it's advisable to use virtual card information when shopping online, so that in case of card compromise, you can generate another one.

Control over International Transactions: It's better to keep this feature switched off when you're not traveling abroad. However, if location-based security is turned off, it's better to keep this feature on to prevent fraudsters from taking advantage of your card when you're abroad.

Virtual Cards: It's recommended to use your virtual card information when shopping online. In case the card becomes compromised, you can generate another virtual card.

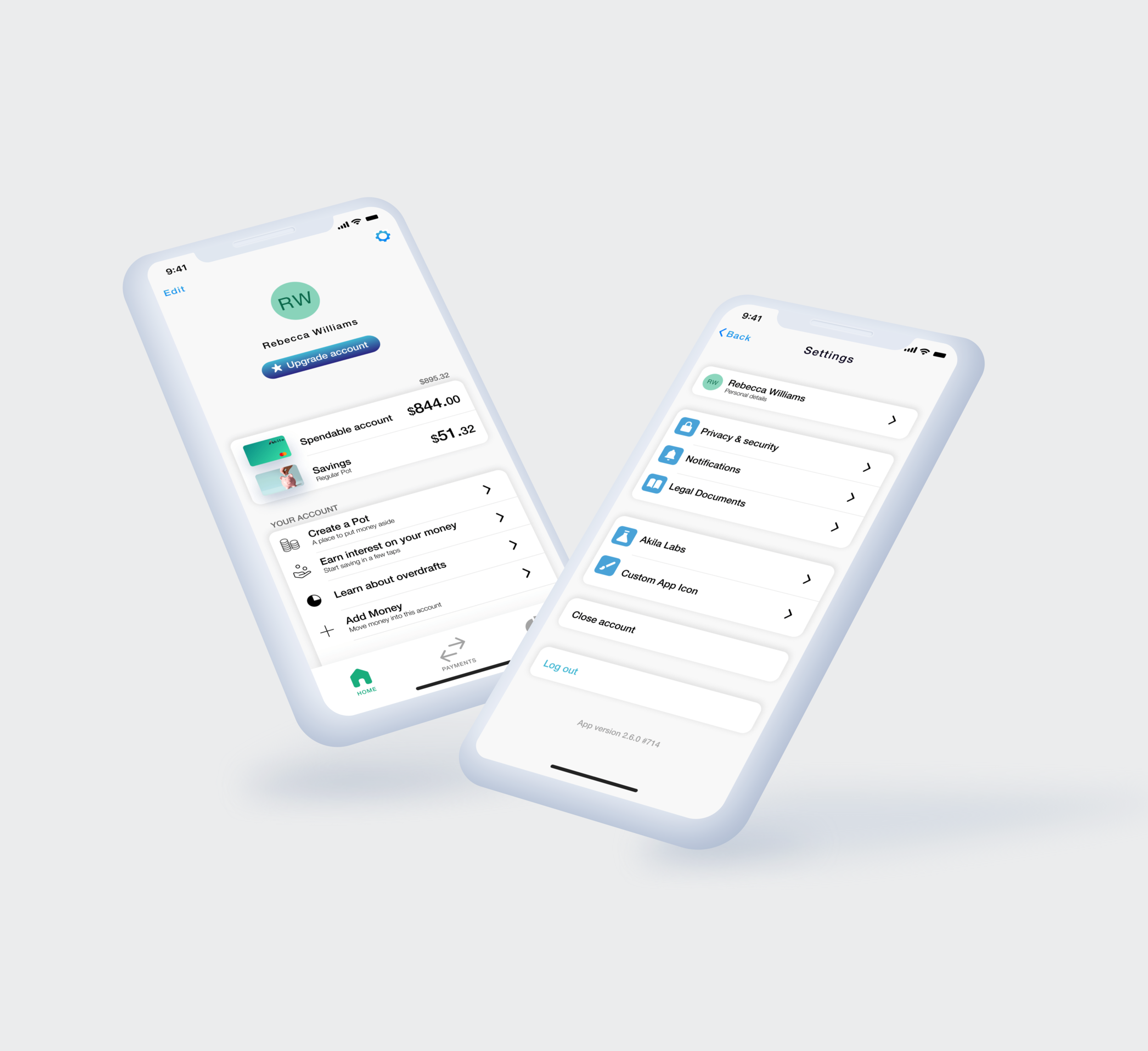

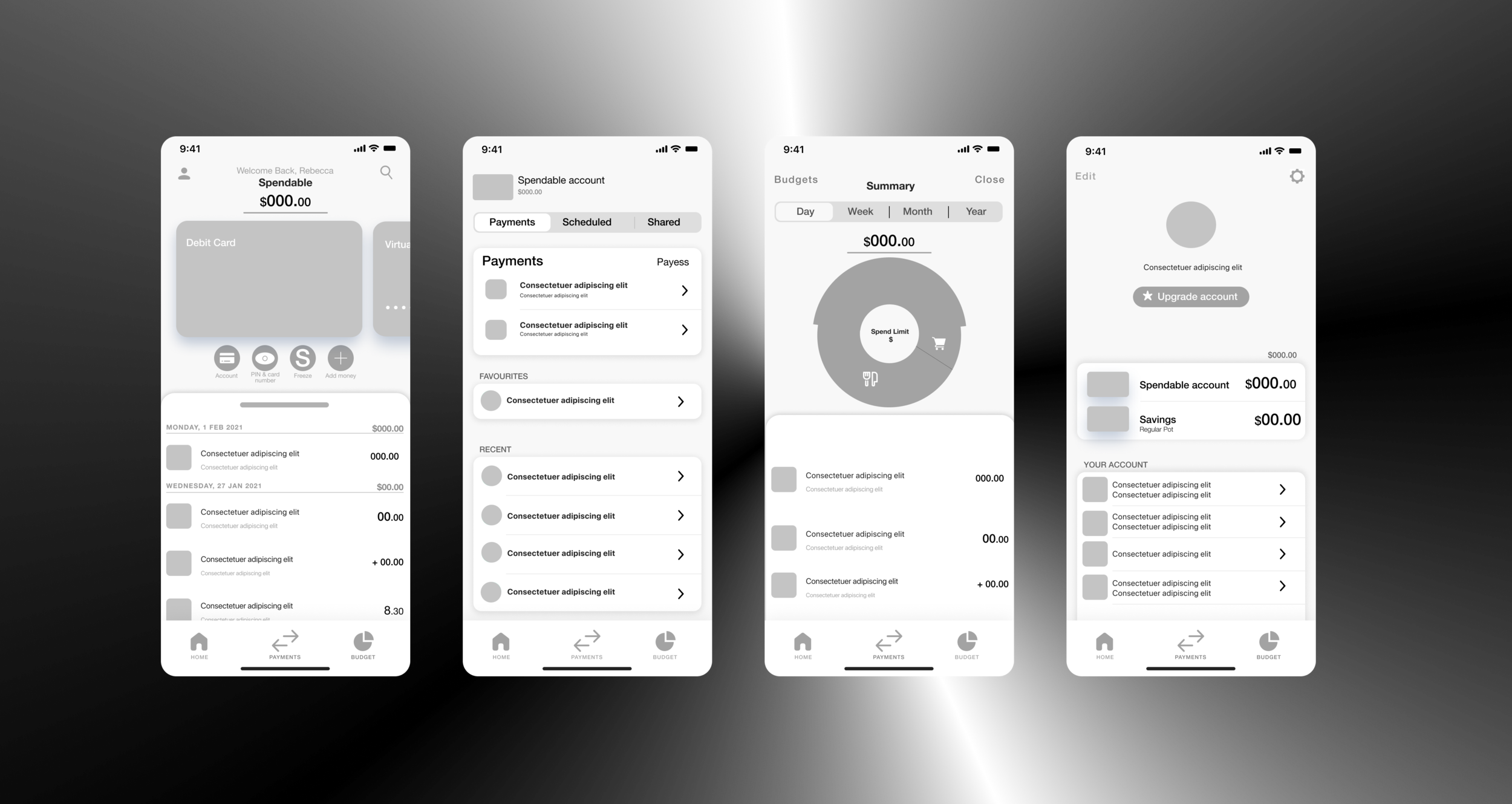

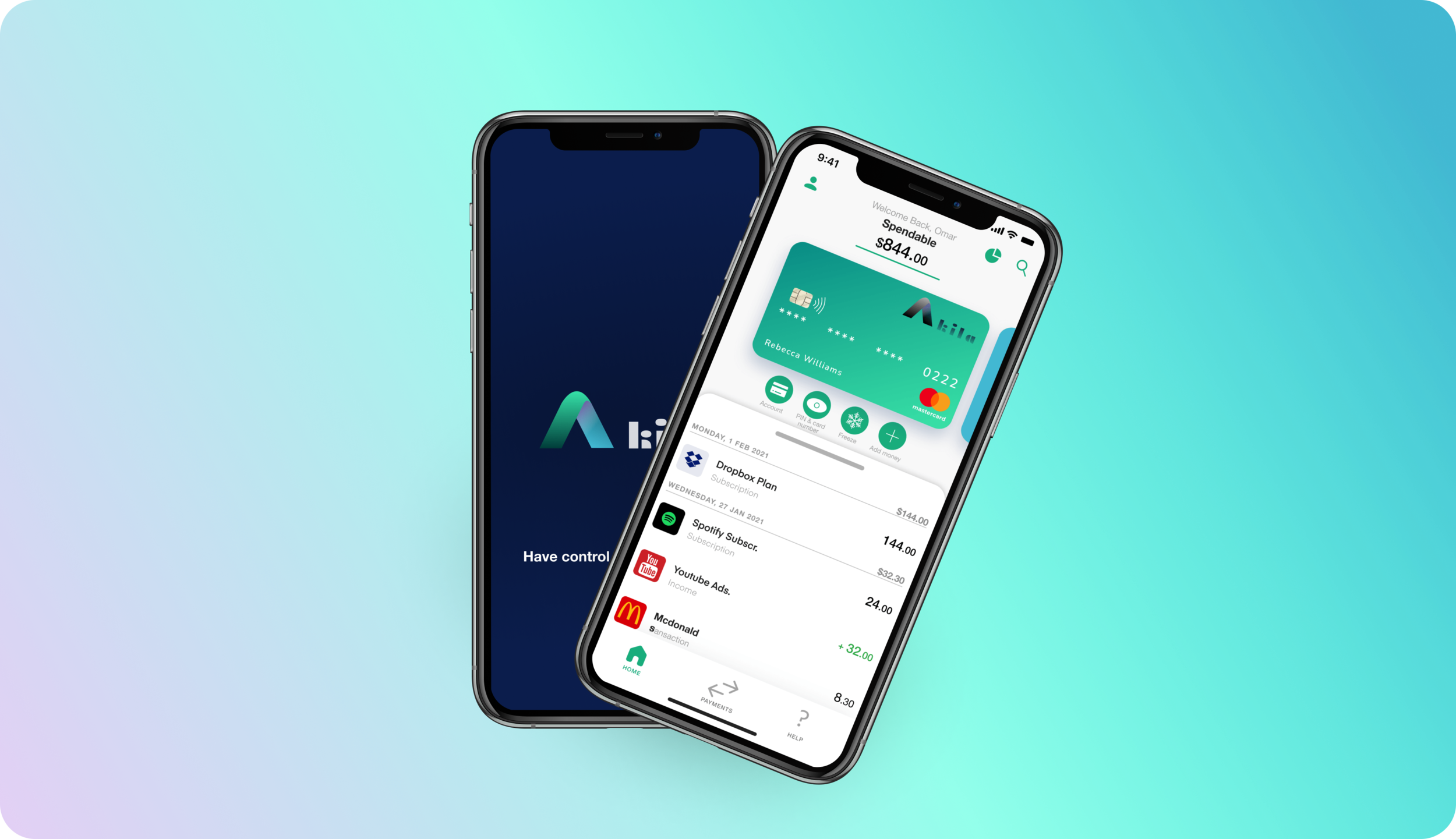

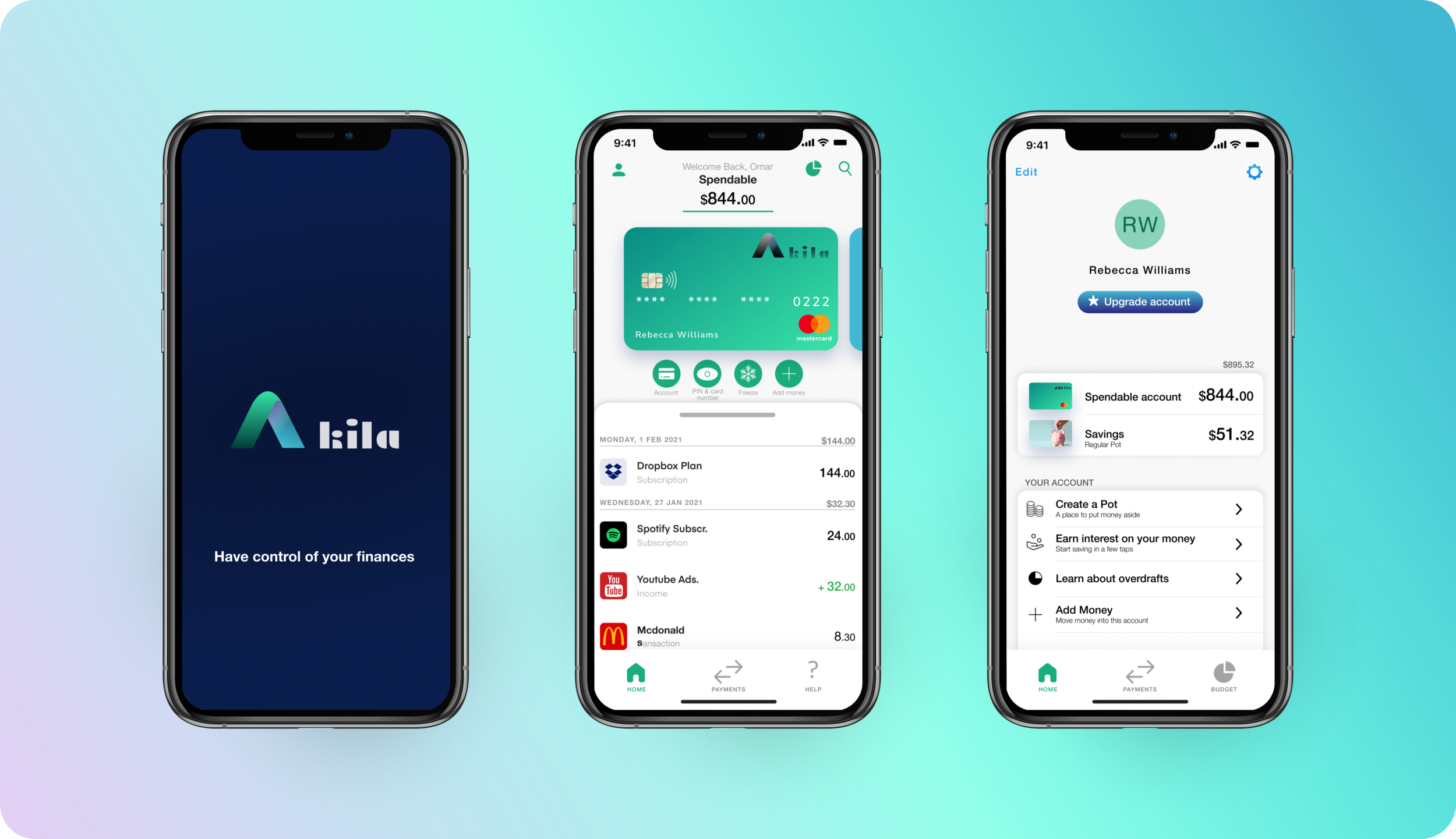

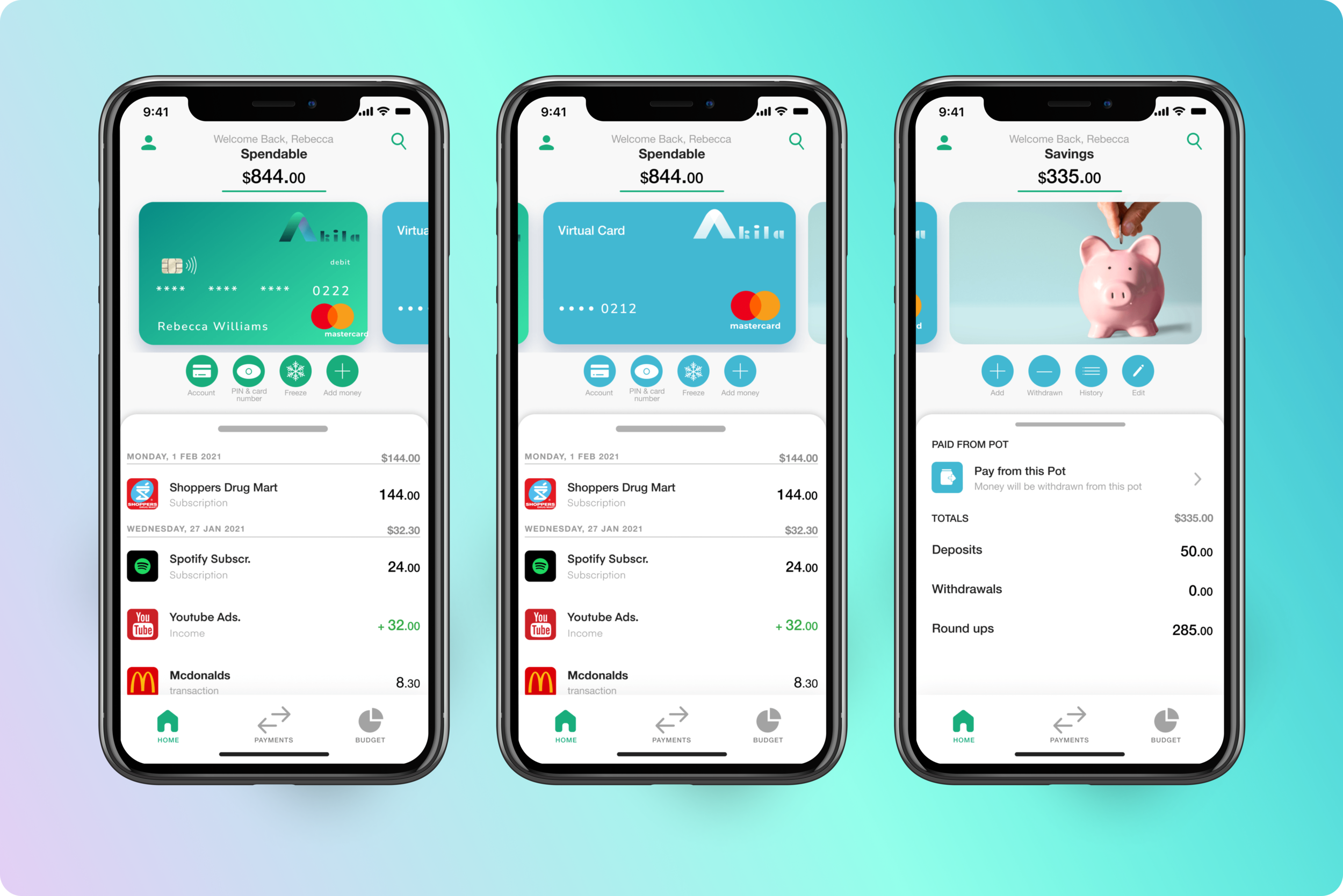

For Akila Fintech, wireframing was crucial to ensure that the app provided a seamless user experience. I created wireframes for various screens, such as the home screen, account dashboard, and transaction history.

For example, the home screen wireframe included key elements such as a navigation menu, account balance, and quick access to frequently used features like making payments or viewing transaction history. The account dashboard wireframe included a summary of account activity and balances, as well as options to add or withdraw funds.

Wireframes were refined and iterated upon until I was confident in the app's layout and functionality. This helped ensure that the app was intuitive and easy to use for all users.

Overall, wireframing was an essential part of the design process for Akila Fintech, allowing the team to create a user-friendly interface that meets the specific needs and preferences of modern banking customers.

1. Planing & Gathering requirements I started by planning out the transaction activity focused home page. I than prioritized which key features I want my app to have, and a new feature the digital banks dont have. such as a crossover with crypto wallet & different world curriences.

2. concept sketches Once I finished my extensive Research I created some quick sketches in figma, making sure my interface to be user friendly and minimalistic as possible.

Open Banking in Canada: The Potential Benefits and Challenges for Financial Institutions and Consumers"

In 2019, a report was released focusing on Open Banking in Canada. The report indicated that Open Banking is coming to Canada and is being driven by the regulatory environment. Large organizations, SMEs, and consumers of transparent and controllable banking services will be demanding it. However, credit unions may see Open Banking as a threat, which may explain why Canada is still so far behind. If Open Banking is implemented, a consumer's bank can share data with a third-party app. This data can be used to generate a credit score, which has already been implemented by fintech companies in the UK. This allows fintechs or SMEs to take data from multiple inputs and use it to drive more actionable insights, help plan budgets better, alert around spending habits, and educate on how to manage money with technology.

While Open Banking sounds easier than it actually is, from a regulatory perspective, there is no real framework of how that data is governed right now. Once we have the right framework where data is provided at a consistent level between all financial institutions, we still have to have the infrastructure to action the data. This is where fintech comes in.If the big banks in Canada do not adopt open banking, we will be at a loss as a nation.

The benefits of open banking outweigh the cons. With open banking, the Canadian financial industry can become more efficient, competitive, and innovative, which will benefit both businesses and consumers. The biggest problem Canada faces is tied-up liquidity because banks cannot communicate with each other, all using different API systems and move money using a messaging system called e-transfer, which takes days to settle in the background. Now imagine if we ran on a standard API system that every bank had to follow, money would move instantly, free up liquidity, and enable better banking for not only the organizations but also the end-users.

However, the government must reject corruption from the Big 5 banks, which are known to use their influence to postpone the adoption of open banking, in order to ensure a fair and transparent financial system for all Canadians.